FAQ

Trucking Insurance Frequently Asked Questions

- Q: As a new owner-operator recently leased to a motor carrier I was advised by the carrier that they will supply the Primary Liability and Cargo insurance I need whenever I move freight for them. My lease contract says I need Non-Trucking Liability coverage. Why do I need that coverage and for what reason?

- A: To fulfill the lease agreement with your motor carrier you must have Non-Trucking Liability protection. This covers your liability while not under dispatch.

- Q: My truck has been parked due to my illness. I have physical damage insurance on the truck, but because finances are so tight do I have to keep the insurance since my truck is not moving?

- A: You may cancel your physical damage coverage at any time. However, if you have a lien holder on your truck, they will probably insist that you continue your coverage in order to protect their financial interests. Even though your truck is parked you are still at risk for theft, vandalism, or other damage such as fire, wind or hail. So you may want to keep your coverage to protect your own interests. If you continue having trouble paying your insurance, call our office and we will try to assist you with special payment arrangements.

- Q: I have Non-trucking Liability insurance but recently have been in a situation where the coverage may not be correct. For example, if I deliver a load to a terminal in a suburb of Toledo and then drive into Toledo to pick up a load there, will my Non-trucking Liability insurance extend to the distance between the two loads?

- A: You will not be covered as the Non-trucking Liability insurance is limited coverage. Your present Non-trucking Liability coverage will only protect leased owner-operators while the truck is being operated for personal convenience and only after you have reached your place of garaging before departing again. Your current coverage will not protect you while driving to and from work or to the repair shop. If your motor carrier dispatches you to Toledo to pick up a load, their liability insurance should provide the coverage you need. For your protection, you should make sure that the motor carrier is actually dispatching you and not just advising you that there is a load in Toledo or elsewhere should you choose to take it. If you’re pulling your own trailer, make sure your motor carrier is actually dispatching you for a load as some carriers have attempted to deny responsibility for claims that occur during these situations. You might want to talk with your insurance agent about an Unladen Liability policy.

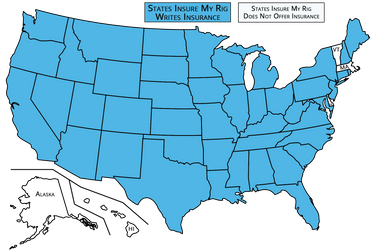

- Q: What states do you provide commercial truck insurance in?

- A: Here is a list of the states that we provide truck insurance for:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

- Q: If I have to have my vehicle towed, will the cost be covered by my insurance?

- A: If you need a tow because of an accident, it will be covered by your insurance. If your truck breaks down as a result of mechanical failure, it will not be covered by insurance.

- Q: I am new to the trucking industry, what type of truck insurance coverage do I need?

- A: You will probably need commercial auto liability, physical damage coverage, motor truck cargo insurance, bobtail insurance, occ/ acc insurance, and non-owned trailer coverage. Every situation is different for every trucker and trailer so it is important that you work with an agent who is experienced in providing trucking insurance. Call the experts today for a comprehensive quote at 888-931-1934.

- Q: Is bobtail insurance the same as non-trucking liability insurance?

- A: Although they are often used interchangeably, bobtail insurance and non-trucking liability insurance are different. Leased operators generally need non-trucking insurance but many people still refer to this type of coverage as bobtail insurance.

- Q. How much does commercial truck insurance cost?

- A: The cost of insurance for your truck will vary depending on several factors but if you would like the professionals at Insure My Rig to provide you with a quote on semi truck insurance coverage, call us at 1-888-931-1934 or simply fill out one of our online forms listed below.

- Quotes on Own Authority Insurance

- Quotes on Owner Operator Insurance

- Q: Do I need occupational accident insurance?

- A: Occupational accident truck insurance can be truly beneficial if you have a work-related accident or illness, especially if you don’t have health care coverage. Talk to the insurance experts at InsureMyRig.com to find out what type of policy would work best for you.

- Q: Should I package my truck payment with insurance? It sounds so easy.

- A: You can, but it will probably be more expensive; definitely give us a call or an email for a quote before getting trucking insurance from a truck dealer. We're the trucking insurance experts, and can almost assuredly get you a better price.

- Q: What’s the difference between primary liability and non-trucking liability?

- A: Non-trucking liability insurance is generally used by owner/operators who are leased onto a motor carrier. When you are dispatched for the motor carrier, their primary liability trucking insurance will cover you. However, if you are your own trucking company with your own customers or if you have your own authority, you will need to get your own primary liability trucking insurance.

- Q: What type of trucking insurance coverage do I need to repair damages that result from an accident?

- A: Physical damage insurance protects truck drivers in the event of an accident. This type of insurance is also called collision insurance.

- Q: If I pay off my truck, do I still need physical damage insurance?

- A: Legally, you do not need this type of coverage any longer if your truck is paid off. However, we recommend you still carry it as this coverage protects your truck which is your livelihood and it is important to have that protection.

- Q: Can I get insurance if I have had a DUI, other infractions or a bad driving record?

- A: At InsureMyRig.com, we make every effort to insure every type of truck driver, regardless of your past driving record. Sometimes, the premium may become prohibitive so we will work with the driver to make sure we find the policy that works for you.

- Q: If I change trucking companies, can I still keep the same insurance?

- A: When you change trucking companies, you can almost always keep the same insurance. Your insurance rates will probably not change at all.

- Q: Is there a penalty for canceling my insurance? Will it affect my credit?

- A: You can cancel your policy at any time without a penalty. Your credit will not be affected by your cancellation. However, you will have to pay any premiums or payments that have accrued on your account before canceling the policy.

- Q: How do I pay my trucking insurance?

- A: At InsureMyRig.com, we make it as easy as possible to pay your trucking insurance. We take credit cards or we will automatically deduct the premium from your checking account each month. Let us know what is most convenient for you.

- Q: If I have to file a claim, how long will it affect my insurance?

- A: Most claims will affect your insurance premiums for three years.

- Q: Should I get my trucking insurance from my truck dealer?

- A: It may sound easy but it is often more expensive to get trucking insurance from the truck dealer. At Roemer Insurance, we are experts in providing trucking insurance and we can work with you to get the best rates available. Before you get an insurance policy from a dealer, give us a call for a quote and compare.

- Q: What does unidentified trailer coverage insurance cover?

- A: A driver may need this type of insurance if you have a trailer attached to your tractor that is not owned or long-term leased you.

- Q: Can I purchase a policy that will protect my personal items in my truck?

- A: Many insurance policies include an option that covers personal items through physical damage coverage.

- Q: What is the difference between pro-rate and short-rate?

- A: If your policy is pro-rated, it means you only pay for the days you are actually insured. When your insurance company charges you for the days insured plus percentage for early cancellation, this is considered short-rate.

- Q: What kind of coverage do I need if I am a lienholder?

- A: Lienholders require physical damage insurance which protects their interest in case there is a trucking accident.

- Q: What are some of the issues with a Motor Truck Cargo policy?

- A: Every Motor Truck Cargo policy is different but some of them exclude or only partially cover certain merchandise such as electronic equipment or clothing. Some of these policies may exclude coverage completely if the truck is left loaded and unattended. Before you purchase a Motor Truck Cargo policy, talk to the professionals at InsureMyRig.com about the provisions in your policy.

- Q: Does InsureMyRig.com assist with getting permits and licenses required to operate?

- A: The experienced professionals at InsureMyRig.com assist drivers in obtaining all of the permits and licenses they may need to operate their trucks safely and legally. For a small fee, we can help you with these permits, including hazardous and special permits.

- For more information or to get a quote, you can call, email, fax or chat with us! Call us 888-931-1934, ext. 292.

- Q. I want to start a trucking company with 5 trucks?

- A. Unfortunately, most of our carriers only allow 1 truck for the first year in business and they require the owner to be the driver. Our markets for new ventures only allow a maximum of 4 trucks for the first full year in business.

- Q. What is the average down payment to start a policy for my authority?

- A. The average down payment depends on the annual premium. Down payments range from 20-25% and the average down payment we see is $2400-$3500.

Q. I want to start a trucking company and haul hazmat- do you have a market?

A. Unfortunately, our markets for hazardous material haulers require you to be in business for a minimum of 2 years running under your authority.

Q. I'm having cash flow problems with waiting to get paid.

A. Check out Thunder Funding knows that it’s critical for your business to keep your cash flowing. That’s why they designed a simple program for motor carriers and Owner-Operators.

"The Whole Roemer Team Has Been Instrumental In Me Being Able To Continue A Profitable Business."

- - Renae Garrett,

- Owner Operator, RG Hauling LLC